Press Release, GSC News

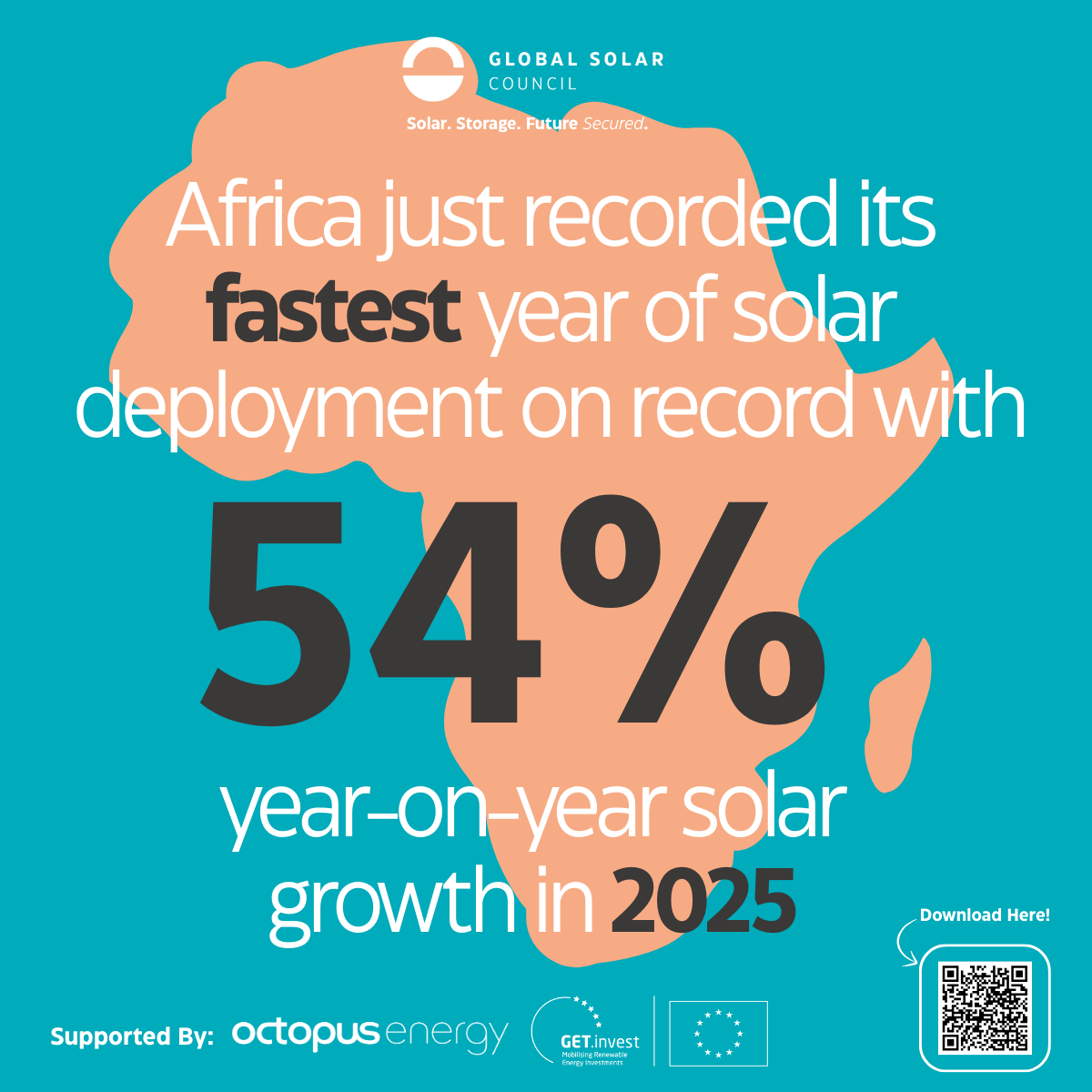

Global Solar Council: Africa Records Its Fastest Year of Solar Growth as Installations Rise 54% Year-on-Year

New Global Solar Council report shows solar deployment spreading across more African countries, increasingly driven by distributed systems and rising demand for reliability — while financing gaps threaten to slow momentum.

Nairobi, 3 February 2026 – Africa recorded its fastest year of solar growth in 2025, with installations rising by 54% year-on-year, according to a new report by the Global Solar Council (GSC). The report finds growth is driven by two parallel solar transitions — utility-scale projects funded mainly by public and development finance, and rapidly expanding privately financed rooftop and distributed systems.

The Africa Market Outlook for Solar PV: 2026-2029, published by GSC in collaboration with its African member associations and supported by GET.invest and Octopus Energy, shows that recent solar equipment imports and deployment trends point to a broader, more diversified market — with households and businesses increasingly driving adoption beyond traditional utility-scale projects.

“Solar + storage is the hope of Africa. This is the technology that can bring energy access, sustainable development, green growth and resilience to natural disasters and extreme weather.” Sonia Dunlop, CEO of Global Solar Council

A market expanding beyond early leaders

The report finds that solar deployment in Africa is increasingly spreading across a wider group of markets, reducing reliance on a small number of early adopters and strengthening the resilience of the continental solar sector. Import data provides clear evidence of this shift:

- Africa installed approximately 4.5 GW of new solar PV capacity in 2025, representing a 54% year-on-year increase and marking a sharp acceleration in annual deployment across regions.

- In 2025, the top 10 solar markets accounted for around 90% of new solar capacity additions, led by South Africa (1.6 GW), Nigeria (803 MW), Egypt (500 MW) and Algeria (400 MW), reflecting continued strength in large, established markets;

- At the same time, several mid-sized and emerging markets — including Morocco (204 MW), Zambia (139 MW), Tunisia (120 MW), Botswana (120 MW), Ghana (92 MW) and Chad (86 MW) — each added substantial new capacity in 2025, reinforcing a trend toward broader market participation.

- In 2025, 8 countries have installed 100MW or above, against 4 last year, essentially doubling the number of countries. Additionally, two countries were closing in on this threshold -(Ghana and Chad). This confirms the trend of diversification identified in last year’s report.

- While utility-scale has accounted for 56% of the installed capacity in 2025; it is important to note that the distributed capacity (44%) is clearly underestimated, as it is harder to track.

- Over the past 4 years, on average the utility scale deployment covered 15% of the imports, thus leaving a high share that cannot be explained by utility-scale projects alone, pointing to rapid and less accurately reported growth in distributed, commercial, and rooftop solar.

- Africa imported 18.2 GW of solar modules in 2025, yet under a medium installation scenario, African countries could install 14.3 GW of mainly utility-scale capacity across 2026–2027 combined. This means that one year of imports exceeds two years of utility-scale deployment. The mismatch between module imports and projected utility-scale installations strongly indicates that distributed solar represents a substantial share of Africa’s solar market.

- Looking ahead, the report’s medium-term outlook suggests Africa could install 21% CAGR by 2029, as distributed and utility-scale markets continue to expand in parallel across a growing number of countries.

“Africa’s solar boom is remarkable, showing just how quickly we can deploy clean energy when technology, demand, and ambition come together. Solar is becoming more accessible, more efficient, and – most importantly – cheaper every year. It’s encouraging to see this potential being realised across Africa faster than ever before, sending a powerful signal of the transformative impact renewable energy can have on communities, businesses and the planet.” Zoisa North-Bond, CEO of Octopus Energy Generation

Two energy transitions, one financing system

A central finding of the report is that Africa is effectively running two energy transitions at the same time:

- a government-led transition, centered on grid-connected and utility-scale solar projects, largely financed through public and development finance;

- a privately financed transition, driven by rooftop, commercial, and distributed solar systems deployed by households and businesses.

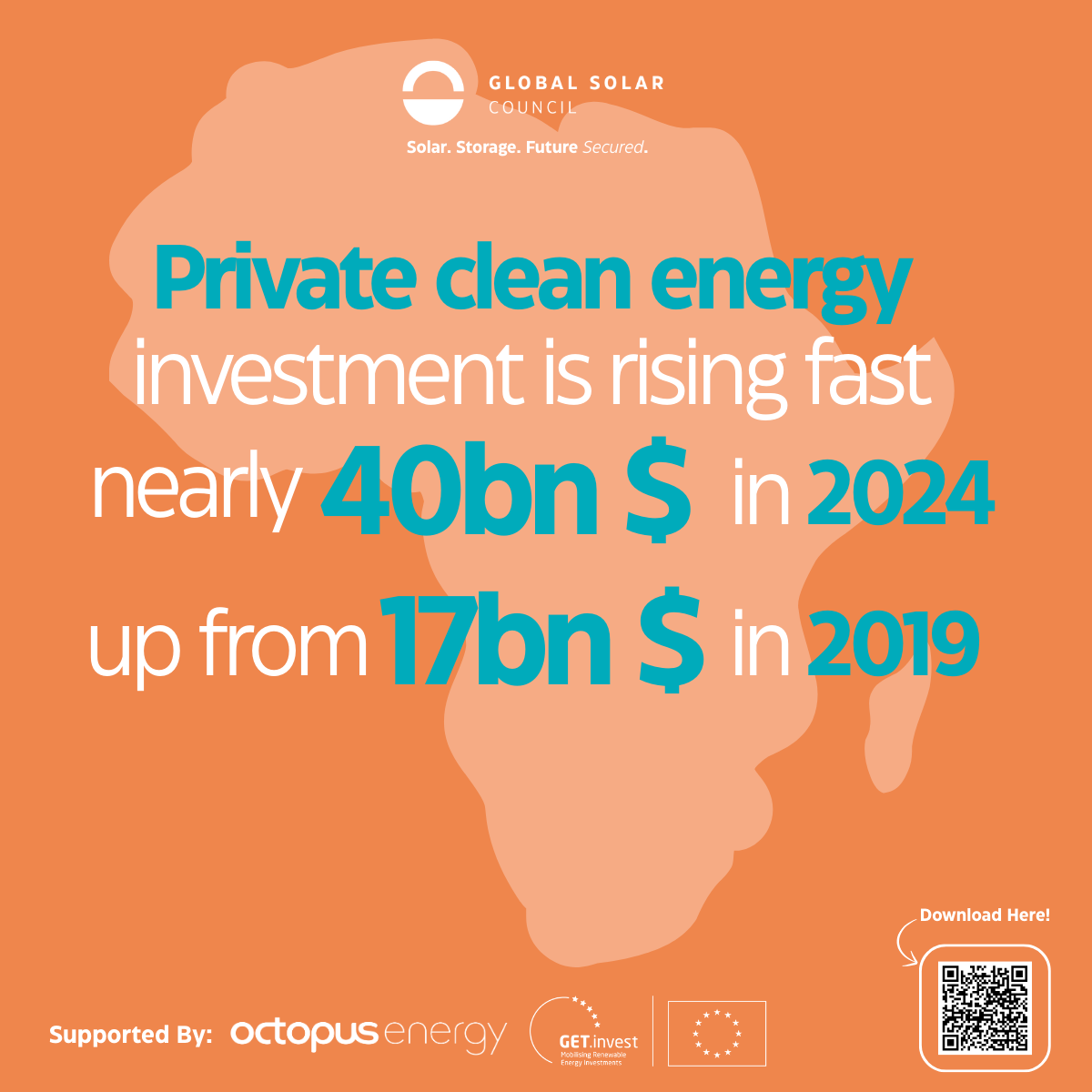

However, financing models have not kept pace with this shift. While rooftop and distributed solar are scaling rapidly, around 82% of clean energy finance in Africa still comes from public and development sources, leaving financing frameworks largely geared toward large, utility-scale projects.

In 2025, utility-scale projects accounted for around 56% of reported installations, while distributed capacity — estimated at 44% — remains significantly underreported, reinforcing the gap between market reality and existing financing models.

Private clean energy investment has increased from around USD 17 billion in 2019 to nearly USD 40 billion in 2024, but remains poorly suited to distributed solar, which requires smaller ticket sizes, shorter tenors, and local currency financing. As a result, many consumer-led and commercial projects face higher financing costs or constrained access to capital, despite strong demand and improving technology economics.

A critical decade ahead

Africa’s solar market is scaling rapidly — yet current deployment still captures only a fraction of the continent’s potential. Despite record installations in 2025, Africa continues to attract a relatively small share of global clean energy investment, even as electricity demand grows faster than in most regions and solar resources remain among the world’s strongest.

“With Africa’s energy demand expected to grow eight-fold by 2050 and the continent holding 60% of the world’s best solar resources, solar paired with battery storage is critical to deliver affordable, reliable power at scale. However, more must be done to attract clean energy investment, with mechanisms to spur public, private and philanthropic financing.” Damilola Ogunbiyi, CEO and Special Representative of the UN Secretary-General for Sustainable Energy for All

The Africa Market Outlook for Solar PV: 2026-2029 finds that the next phase of growth will be shaped less by headline capacity targets and more by system readiness. As deployment shifts toward distributed, consumer-led and commercial solar, existing finance, planning and regulatory frameworks are increasingly misaligned with how the market is actually evolving.

This misalignment carries real risks. Without reform, it could slow deployment, raise system costs and limit the economic value of solar. With the right policy and market signals, however, the upside is significant: the report’s medium-term outlook suggests Africa could install over 33 GW of solar capacity by 2029 — more than six times the capacity added in 2025 — as distributed and utility-scale markets expand in parallel across a growing number of countries.

Realising this opportunity will depend on aligning finance, planning and regulation with market reality — enabling solar and storage to deliver not only clean power, but reliability, economic productivity and long-term energy security.

To support this next phase of growth, the Global Solar Council calls for:

- Finance models fit for distributed and consumer-led solar, unlocking investment in rooftop, commercial and captive systems that are increasingly driving deployment

- Improved data collection and planning frameworks that reflect where and how solar is being deployed, ensuring grid and investment decisions keep pace with market evolution

- Accelerated investment in storage, grids and system flexibility, to maintain reliability and support rising industrial and commercial energy demand

- Stable and predictable policy and regulatory environments, to reduce risk, crowd in private capital and enable long-term project pipelines

About the Global Solar Council

The Global Solar Council (GSC) is the united voice of the solar industry worldwide. As a non-profit trade body, our vision is to create a fair and sustainable world with solar at the heart of a new energy economy. Driven by our passion for a cleaner, more just world, we work as a community to ensure everyone’s voices are heard, advocating for swift progress to be made in the battle for the climate. We advise governments on the pressing issues central to the solar transition, including finance, grids, skills, sustainability and supply chains.

Get involved at www.globalsolarcouncil.org and follow us on LinkedinIn, X, We Chat, Instagram

About GET.invest

GET.invest is a European programme that mobilises investment in renewable energy. Services are primarily aimed at private sector companies, project developers and financiers in sustainable energy markets in sub-Saharan Africa, the Caribbean and the Pacific. The programme provides tailored access-to-finance advisory for clean energy developers, a funding database, market information, and financial sector support to increase local currency financing. Find out more at https://www.get-invest.eu/

About Octopus Energy

Octopus Energy is a global clean energy technology company driving the transition to a smarter, more flexible energy system. Through its Kraken platform, Octopus manages energy systems for millions of customers worldwide, enabling the large-scale integration of renewables, storage and flexibility.As a major investor in renewable energy, Octopus supports the expansion of utility-scale and distributed clean power, helping unlock new market models that improve reliability, reduce costs and accelerate the transition to affordable, low-carbon energy. Find out more at www.octopus.energy

![Global Solar Council [logo]](/static/images/gsc-logo-horizontal.svg)